Enjoy being online again!

Welcome to the community of good people who base their values on evidence and appreciate civil discourse - the social network you will enjoy.Create your free account

6 comments

Feel free to reply to any comment by clicking the "Reply" button.Another very simple example to explain how completely insane the 2nd point is.

Assume you have two companies. Company A and Company B. Both companies make $1,000,000 per year in profits.

Company A is taxed at 90%, so at the end of each year, after paying taxes, Company A has $100,000 to reinvest back into growing the business.

The takes the taxes from company A and 50% goes to defense, then 40% goes to Company B.

So at the end of each year, after paying taxes, the money each company has to reinvest back into its business is:

Company A: $1,000,000 (- 90% taxes) = $100,000

Company B: $1,000,000 (+40% subsidy) = $1,400,000

If Company B has competent management, it will grow much faster than Company A because Company B has 14 times more money to reinvest back into growing the business each year.

Now assume all Company A's are in the United States, and all Company B's are in Japan and West Germany.

I have described exactly what happened in the 1950's when US companies were taxed at 90% and Japanese

and West German companies were heavily subsidized. That's why we started to see so many Toyota, Honda, VW, Mercedes, and BMW cars in the road by the early 1970's.

Don't take a job as an accountant you don't understand taxes at all.... NO COMPANY IN THIS COUNTRY PAYS TAXES ON GROSS REVENUES.... Business taxes are ALWAYS ON PROFITS.... I won't even bother with the rest of the errors you made because everything in your "example" is pure fiction...

In other words you just showed complete ignorance from the very start.

BD66:

@Lizard_of_Ahaz Both companies make $1,000,000 per year in profits.

@BD66 You still fail as this country uses a progressive tax so all money in the first tier id taxed at that rate then the second tier is used then the third and so on so the actual rate is less than 90% and if the company's strategy is right the not only pay very little in taxes on company A but also have happier investors paying larger dividends to them so stock prices go up. In the case of company B they just send the money to an offshore bank and let it sit drawing interest but doing nothing for the economy. This is the problem we have now with over 30 trillion dollars sitting in banks doing nothing those companies are paying no taxes on. In this country alone we have fake charities owned by billionaires hoarding an additional 1.7 trillion at last count doing nothing charitable at all....

The real issue here is you think of sociopaths as altruistic... They only want money and power...

As for the Subsidies to West German and Japanese countries those were to rebuild their infrastructure since this was done from the ground up they used the latest technology making manufacturing cheaper. US businesses had the same opportunity which would have lowered the taxes they paid but refused to do it instead paying large sums of money to executives who did nothing. So once again you fail....

BD66:

@Lizard_of_Ahaz Lots of points there:

You still fail as this country uses a progressive tax so all money in the first tier id taxed at that rate then the second tier is used then the third and so on so the actual rate is less than 90%

BLD> It was a simple example.

and if the company's strategy is right the not only pay very little in taxes on company A but also have happier investors paying larger dividends to them so stock prices go up. In the case of company B they just send the money to an offshore bank and let it sit drawing interest but doing nothing for the economy.

BLD> Dividends get paid out of after-tax income, so Company A had $100,000 to split between dividends and reinvestment. Company B had $1,400,000 to split between dividends and reinvestment. That's what made Company B so attractive to investors, so Japan and West German stocks had an amazing run when they were receiving all the subsidies from Uncle Sam.

This is the problem we have now with over 30 trillion dollars sitting in banks doing nothing those companies are paying no taxes on.

BLD> $30T sitting idle in banks is a problem. They would pay taxes now if they received any interest on the cash.

In this country alone we have fake charities owned by billionaires hoarding an additional 1.7 trillion at last count doing nothing charitable at all....

BLD> I agree 100%. Jeff Bezos is sitting on $150,000,000,000 in unrealized capital gains and his ex-wife is sitting on $50,000,000,000 in unrealized capital gains. That money will never be taxed because it will go into the Bezos family trust.

The real issue here is you think of sociopaths as altruistic... They only want money and power...

BLD> Off topic. No reason to respond.

@BD66 Most money that would be taxable today is used by large corporations to preform "stock buybacks" which are then used to overpay executives using "stock incentives" even though many of these people are criminals or just plain incompetent like the case of Meg Whitman and HP showed...

BD66:

@Lizard_of_Ahaz Agreed, and the Federal Reserve's ~0% interest rates make it easy for the companies to borrow more money to buy back their stock, driving up the stock prices and rewarding the executives for doing absolutely nothing.

No comment on the criminals or incompetence issues.

@BD66 According to the Economic Policy Institute Trump's Tax scam and no jobs act was failing before the pandemic and we already had a loss of productivity nearly equal to the Bush crash... Even without the pandemic it would have eventually reach the stage we are at now before rioting started....

BD66:

@Lizard_of_Ahaz You must have been on some strong stuff last night.

@BD66 You should really get that religious delusion looked at....

The Reasons Conservative Economics Can't Work.

Dollars in circulation change hands sometimes dozens of times a day when removed from circulation they restrict the ability of businesses to make sales reducing income which especially hurts small businesses without large cash reserves. When this money is out of circulation demand for products and services is reduced reducing the number of employees needed. In the US our economy is based 70% on consumption of goods and services so removing one middle class job will often result in the loss of two or more jobs further down the economic chain.

Reducing taxes on large corporations lessens the amount of tax deductions needed by the corporation to increase their profit margin but this is not a advantage for the employees of the corporate structure. When a corporation like Apple finds it is able to reduce it's costs further by having products assembled in China where workers are paid a dollar or less per hour and often work 16 hour days without overtime or benefits in unsafe conditions it can shift thousands of jobs that had starting wages of 15 dollars an hour over there leaving low paid retail and shipping jobs here. Also for every American worker laid off when a factory is closed in the US it takes 4 Chinese workers to replace him. While this can result in an increase in profit of 15 or 20 dollars a unit. The damage it does though is to remove 15 to 20 thousand factory jobs here plus at least 45 to 60,000 more jobs from the economic chain. Tariffs were placed on goods shipped to the US for a excellent reason and the WTO and NAFTA removed those it made it the economically feasible for big corporations to ship the products and still cost less than manufacturing them here. While this may look attractive on the books it often exploits children and entire families keeping a cycle of poverty in the country the factories are located leaving a moral issue which could destroy the corporations reputation and lower sales volume.

There are also several economic problems with this approach to business one of which is the people you have put out of work cannot afford your products reducing your market. Another is in addition to reducing the market you are reducing the tax base (number of people who pay taxes) putting further strain on your own economy. Still another problem is in most countries where workers are exploited there are no regulations regarding disposal of hazardous waste which as the Chinese are finding out is a larger problem than they first suspected. This is now costing their economy hundreds of billions of US dollars every year in lost production of food stuffs, medical problems, and cleanup. Nigeria is completely devoid of life in some areas that used to be thriving ecosystems and many other countries are having similar problems. Many people in the US hear about this and just say to themselves “so what that is a long way off it doesn't effect me” this couldn't be farther from the truth. The air you breath isn't produced just a few feet from you it circulates around the entire planet. Most CO2 is processed by algae in the oceans back into O2 which you breath and when other countries dump toxins in their rivers it ends up eventually in a ocean near you (you might even swim in it). Food is often shipped from outside the US now and may contain many of these poisons as well.

Now consider that big corporations are allowed to use tax shelters as well so they can send money to offshore banks legally and not be taxed. This also encourages hoarding taking large sums of money out of circulation and further damaging the economy. What most conservative voters fail to see is that money put into circulation is tax deductible also money spent increasing efficiency and reducing pollution is also tax deductible as well as creating more jobs. Also it allows smaller businesses to compete with larger ones because they pay a lower tax rate instead of a higher one as they do under the Bush system. Also there is an increased demand for products which means more money all around when more people are employed at jobs that pay higher wages. So far we are seeing the conservatives in office block any tax reforms in this country and this will result in the same problems caused by Bush implementing these policies. “Trickle down economics” only works when you have customers with unlimited buying power and a source of exploitable cheap labor to trickle it down to. The problem lies in the math without the unlimited funds to buy the products (earned with good paying jobs) you can't afford to exploit the cheap labor to produce the products for people to buy with the money they don't have. Like trying to control machinery using positive feedback it oscillates completely out of control.

I will explain why the second one is completely insane. It’s best to look at the issue in terms of supply and demand. During WWII, almost every industrial country in the world had its infrastructure bombed out. The countries were almost bankrupt as well. The United States was the most notable exception. We emerged from the war with a large portion of the world’s investment capital, a large portion of the world’s industrial infrastructure, and only 5% of the world’s labor. In terms of supply and demand, there was a huge demand for US labor and a small supply of US labor, thus US laborers enjoyed a standard of living they never had before and never will again.

During that time, (the 1950’s), a kid in my home town could drop out of high school, get a job at CAT operating a drill press, get married, buy a house, buy a car, raise a family, then retire at age 50 with a pension and healthcare benefits for the rest of his life.

What killed all that was the Marshall Plan and our obsession with winning the Cold War. If US Corporations had been allowed to keep more of their profits, they would have had more money to pour back into their factories, so the demand for US labor would have continued to grow, but The Marshall Plan and Cold War related spending took most of the profits from running factories and industries in the United States and sent those profits overseas to countries like Japan and Germany to help them build their factories, and it also sent the profits into the defense industry so we could defend the entire “Free World”

By the early 1970’s you started to see VW bugs, Mercedes, BMW, Toyota, and Honda cars on the road. You also started to see Sony consumer products in the home. That would not have been possible so early if the US Government had not taxed US companies at such extremely high rates and sent that money overseas to be invested in foreign factories.

By the late 1970’s there was so much foreign competition it took away almost all collective bargaining power of US unions. When CAT workers went on strike in 1978 and 1983, CAT management crushed the unions. Similar things happened in the same time frame in the auto industry. There was already enough labor that could be tapped in foreign countries that it was no longer possible for US workers to demand a huge premium over their foreign counterparts.

Now move forward to the end of the Cold War. When the Iron Curtain and the Bamboo Curtain fell, the labor of people in Eastern Europe, the USSR, China, Vietnam, and India became available to anyone who had money to invest. The world’s supply of free-market labor increased by a factor of about 5, while the world’s supply of capital did not increase by much at all. So with much more labor and only a little bit more demand for that labor, the price of industrial labor went way down.

It became extremely profitable to move the textile factory from Massachusetts to Vietnam or India because the labor there was 10 to 100 times cheaper. Globalization made possible by the end of the Cold War was a good thing for the majority of low-skilled laborers around the world. It brought about a huge improvement in the standard of living for workers in China, Vietnam, Malaysia, and India. However it was a terrible thing for low-skilled laborers in the USA because they have been forced compete on an equal footing with laborers in other countries that were once making 10 to 100 times less than they were for each hour of work.

You just failed economics, business and basic tax accounting all in one stupid rant....

The Economics of Corporate Welfare

Randall Morris

Large corporations are the real beneficiaries of the social safety net and the main reason so many tax dollars go to feed the poor. They use subsidies like SNAP and housing assistance to inflate their profits while lobbying government at all levels for tax breaks and subsidies for themselves. Among these giants Walmart with over 18 billion in profits for 2012 is the single largest welfare queen in the US. Meanwhile McDonalds is close behind in the number 1 spot for the restaurant industry. These two corporate giants account for tens of billions in corporate welfare every year.

Average citizens who pay taxes never hear of this fountain of wealth the rich dip their buckets into while the poor receive theirs from an eyedropper. Most people never see that those Sheeple screaming in fear about socialism and how it is “taking over the country” are being led by the real socialists. The ones who are placing a real drain on the economy while returning nothing of real value and damaging the very economy they depend on not only to make profits but also give that money they have kept as profits its value. People in the US tend to take the value of money as an absolute without thinking about it as a concept. What is a “dollar” really? A “dollar” like any “money” is a fiction that is backed by the stability of economy of the country that issues it. This means that in countries with unstable or bad economies the value of the money is worth far less than a country with a strong economy. This is because (and investors in peculiar) trust that the government issuing has the ability to repay its debt.

Debt is the main issue in determining how well an economy is doing and yet here in the US most people have no idea how it works. All countries must “borrow” money to pay their bills even though they are the ones printing that currency. This is done by selling bonds which are the promise of the government to pay the holder his/her principal (the amount paid for the bond) plus a set amount of interest when the bond “matures” (a set amount of time agreed on between the government and investor at the time of purchase). The better and more stable the country and its economy is the more desirable the bonds it issues are so the lower the interest it pays on the money it borrows. These bonds can NOT be “called” (demand for early payment) by an investor that is a fiction invented by conservative elements to scare people into thinking of debt as a liability. As long as the country is collecting enough in taxes to pay the interest on its debt it can always issue new bonds in the same amount as the old ones to cover the principal extending the due date indefinitely. This makes the concept of “how much each person “owes” on the national debt” a meaningless concept. This leaves the sole problem for any government in paying its “debt” as collecting enough money to pay the interest on that debt which is done by collecting taxes.

This is where many countries (ours included) get themselves into problems the actual collecting of the taxes. Taxes can be either an asset to the economy or a disaster. The concept of a sliding scale was invented to encourage reinvestment in the economy by the wealthy thereby keeping money flowing and the job market growing. When government lowers the tax rate in one area it causes more investment in that area because it becomes more attractive for investors especially the rich ones to place their money into that market. When the capital gains tax was lowered to 15% that was a boon for Wall Street but severely hurt productive areas of the US economy as many large businesses, and banks diverted those funds that would otherwise been used to increase productivity and efficiency to non-productive markets instead of creating new jobs. This also caused another problem where corporations started to lobby for tax subsidies and breaks in their primary area of business so there would be less need to reinvest in production to lower tax liabilities.

The current mythos in society is the lower the tax a company pays the more money it has to create new jobs. Nothing could be farther from the truth because the money used to create new jobs is never taxed, taxes are on profits not earnings and the two are completely different concepts. Earnings are the total income through sales and investments of a business while profits are what a business keeps after paying its operating costs including employee wages and benefits. This also means that keeping employee wages low is a boon to company profits which is why we have a minimum wage. The whole concept of the minimum wage was arrived at to force companies to pay employees enough to live on and support a family. This has the side benefit of creating more working class jobs that pay taxes. When a large corporation like Walmart or McDonalds pays less than 9% in taxes on profits it is bad enough but to have a lower minimum wage makes matter worse. Less taxes paid means less ability of the government to pay the interest on its debt forcing it to borrow more money to pay interest as well as the principal. This not only takes large sums of money out of the economy leaving less money in circulation thereby slowing sales and further depressing the economy but also lessens the confidence of investors raising interest rates on future bond issues.

Excerpt from The Economics of Unreason.

All rights reserved by the author

BD66:

@Lizard_of_Ahaz The differences between you and me:

- I posted something I wrote myself. You are not capable of posting something like that, so you have cut and pasted an article written by a third party.

- I can divide, and you cannot.

It makes no sense for use to continue a discussion.

@BD66 Incorrect on both counts.... I wrote both articles I posted here.... Also I when I was in the 5th grade I was doing Algebra... I wrote them both simply so even idiotic economic illiterates could understand the subjects....

@BD66 Oh and here is another I wrote that I keep meaning to go back and update when I get the chance....

When the no government set spews nonsense why are they able to find people stupid enough to listen?

This is especially apparent when you listen to the average Ron Paul supporter who can't do simple math, has no knowledge of how economic systems work, doesn't understand government at all or how it works, and thinks corporations will somehow police themselves because “Ron Paul told them so.” The incredible lack of even basic knowledge of history alone puts them on “Jerry's short bus” wearing a tinfoil lined bicycle helmet and underwear with a name tag in it so if they forget who they are they can always ask someone to read it for them. Let's take this slowly so even a complete idiot can understand how bad the Ron Paul economy would be for the average hard working person who may or may not still be in the middle class.

According to this idiot savant child labor laws are “stupid” and are the main reason for the wealth differential between the middle class and the 1%. Disregarding that few children have education enough yet to get work that would make much money to close this gap in any degree at all the laws are to prevent the exploitation of children by forcing them to provide reasonably safe working conditions and decent pay instead of locking them into firetrap sweatshops while working them 12 hour days with beatings for not making quotas. Most of the Republican candidates have publicly agreed that this is the direction which they want the country to go in and would work tirelessly to that end.

Also he would remove the minimum wage so companies could then hire 5 or more people for what they are now required to pay one(meaning he thinks you can live on 1.00 to 1.50 an hour with no benefits at all). Of course if you can't pay for your own health insurance you are completely fucked if you need medical care to save your life because you can't afford a place to live much less food on his idea of a “living wage” so how could you afford health insurance? Oh and the best part if you are out sick? Fuck you after all there are always more slaves... er … workers where you came from right?

All this so he can give the “job creators” enough money to make jobs by not taxing them (oh but how to reconcile this with being against “crony capitalism” …..) you can't of course because he is without a doubt one of the worst offenders working tirelessly on the behalf of his cronies the Koch brothers. The problem with this theory is that these “job creators” have about 25 trillion dollars stashed in banks worldwide and have no desire to either pay taxes or create jobs with it. They just want more money and no taxes the only problem is when the money all sits in one place it doesn't create more money.

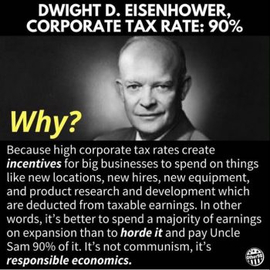

Historically higher taxes on the upper class have always created economic growth, when those at the top have a high tax rate and they want to keep their money they spend it on things that increase their net value. Spending on factory improvements to increase output, or reduce pollution which environmental laws force them to make anyway create more jobs (what intelligent people call a win/win situation). What justification is being used to make lowering taxes for the rich seem reasonable assumes that they would be filing form 1040EZ instead of taking full advantage of the tax credits they can earn spending money creating new jobs. This is how with the present low corporate tax rates big corporations like Mobil/Exxon receives back hundreds of millions in tax refunds they never paid to the government. This wouldn’t be so bad if their tax rate was reasonable but with the present structure they need only a minimum of deductions to pay nothing in taxes creating few jobs and outsourcing everything they can to countries that they pay nothing for labor and are allowed to dump toxic waste at will.

Just the recycling laws alone have created hundreds of thousands of profitable jobs, reduced the prices of materials, reduced the need for landfill space, and saved the big corporations billions of dollars much of which they don't even realize. Since it costs less to recycle a product than make it from raw materials or mine and then smelt it the cost of materials is reduced along with lowering waste disposal costs. Companies also can sell the waste for money generating additional income. When FDR raised the tax rate to 91% in the 1930s' the GDP shot up over 1200% and when he was advised to cut those taxes the almost immediate effect was a slowing in the economy because the rich no longer needed those tax credits creating new American jobs. As a result he raised them again strengthening the economy in time to prepare this country for WW2.

Ron Paul has also made noise about how churches could take care of the poor while a good idea in some ways most churches have that ability only because of government programs he wants to eliminate like food banks. Others that have a real ability refuse to help the poor ask any televangelist for help and he will ask you for money. Of course there are a few private ones that run on donations but they would dry up fast when nobody had money or food to donate to them, and with no taxes to encourage the rich to support them we could forget about them helping. Public education would be gone as well so your children and grandchildren would be uneducated unless you can afford to pay to have them educated. (hard to do when you can't even feed them).

I could go on like this for days but unlike some people who brag about how great Ronny boy's ideas are both elitist as well as unworkable. I have to produce in order to stay in school as well as find some way to make a living after graduation (being in a debtor’s prison would make that difficult not to mention being a slave to a corporate prison system being what I feel is a bit regressive). Ron Paul on the other hand never produces anything and receives a small fortune for his efforts at obstructionism to the American way of life.

#2 is completely insane and the reason why American workers have such a low standard of living today.

You just failed economics..... Workers had a higher comparative average standard of living when taxes on the wealthy were higher than they do today. A completely ignorant statement like yours which is easily disproved by facts shows that if brains were high explosives you wouldn't have enough to blow your own nose....

FYI employee salary and benefits are a cost of doing business and when taxes were high big corporations used to pay better salaries and benefits to attract good workers. Since the upper tier taxes on profits went way down and congress gave tax incentives for moving production facilities to countries that allow exploration of workers and in some cases outright slavery along with a lack of tariffs on goods made by American corporations in those countries there is no incentive to those people to pay a living wage. Also dumnbass corporations don't pay taxes on revenue they are call "Pass throughs" for a reason the investors are supposed to get paid back in stock dividends which the low tax rate eliminates the incentive for them to do as those come from yearly profits and as such those funds lower the amount of taxes paid by corporations and by going to investors helps boost the economy by putting money into circulation again.

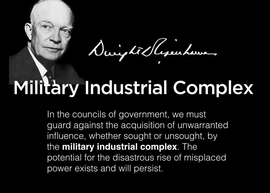

Now he’d be called a damn socialist. The corporate take over of America is almost complete.

Actually "Tail Gunner Joe" McCarthy accused him of being a "commie"

@Lizard_of_Ahaz Yah I remember McCarthy was on a witch hunt back then

@Rudy1962 This country would have been saved a lot of problems if they had just dumped that prick over the Sea of Japan hog tied wearing a flak jacket...

@Lizard_of_Ahaz And unfortunately from my state of Wisconsin. We’re known for McCarthy and Dahmer

Called by who?

That would be historians....

[cnn.com]

Recent Visitors 40

BD66

Bloomington,

Lizard_of_Ahaz

CA, USA

RobertMartin

MS, USA

AndyFreakingFord

South Gate,

1EarthLovingGal

.,

Photos 77,314 More

Posted by noworry28So no free gas ever.

Posted by glennlabParenting is hard when you're honest

Posted by glennlabI proudly served, even if it was reluctantly, for 6 years.

Posted by bookofmoronscouldn't hurt I guess

Posted by KilltheskyfairyHelpful memes…

Posted by KilltheskyfairyHelpful memes…

Posted by bookofmoronsBible science - love sending this to rapture nuts

Posted by noworry28Yeah, that's usually how it works. Knowledge and education allows one to free his or her mind to apply critical thinking.

Posted by glennlabOlder adults too, some of us never plan on growing old.

Posted by glennlabRobin still has words of wisdom.

Posted by noworry28Religion, the enemy of progress.

Posted by bookofmoronsNature never ceases to amaze me. the things you see at the Smithsonian

Posted by CliffordCookTell me again about how Easter is about Jesus rising from the grave like a zombie. I love that joke.

Posted by glennlabGive a hand up when you can.

Posted by glennlabBe on the look out.

Posted by Ryo1And that was God's plan! 😆