Who Will Do Something About the Looming Retirement Crisis?

In Douglas Coupland's 1991 age-warfare classic novel "Generation X" a young man trashes a car because it bears a bumpersticker with the obnoxious slogan "I'm spending my children's inheritance." Like Coupland I launched my career as something like a spokesperson for Generation X, raging on behalf of a demographic cohort perpetually struggling to make itself and its concerns heard in the wake of the older, bigger and wealthier Baby Boom generation. Culturally marginalized by the Boomers, forced to accept transient employment, hobbled by growing student loan debt and buffeted by recessions, Xers feared that they would never be able to save enough in order to retire, much less spend their kids' inheritance.

*The retirement crisis will be worse than we ever feared.

"We predict the U.S. will soon be facing rates of elder poverty unseen since the Great Depression," New School economist Teresa Ghilarducci and Blackstone executive vice chairman Tony James write in the Harvard Business Review.

- Sayonara, Kurt Cobain. Born in 1961, the oldest Xers are graying, aching, 57. And in trouble. A New School study projects that 40% of workers ages 50-60 and their spouses who are not poor or near poor will fall into poverty.

Retirement specialists from the political left and right concur: big segments of whole generations of the elderly will soon be impoverished, some homeless or even starving. After the Xers, the Millennial deluge; old age looks even bleaker for today's young adults.

Experts vary on how much you should have saved by the time you retire. Fidelity advises a $75,000-a-year worker who retires at age 67 to squirrel away at least $600,000 in present-day dollars. Following the traditional rule of having 80% of your salary for 20 years pushes that desired minimum to $1.2 million.

The problem is, the average savings of 55- to 64-year-olds is a piddling $104,000. According to a 2015 study of people 55 and older by the General Accounting Office, 29% have nothing whatsover.

It's a joke, but it's not funny. Yet neither political party has much to say about the looming retirement crisis.

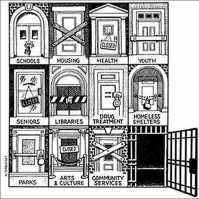

The rapidity and scale of downward mobility among the elderly will shock American society, precipitating political upheavals as dramatic as those we saw during the 1930s. Political and business leaders are in denial about this issue. But the desperation of our grandparents and parents -- not to mention the children charged with caring for them since they won't be able to provide for themselves -- will make voters vulnerable to demagoguery of all stripes. Instability will be rampant. Democracy could be in danger.

It isn't hard to see how we got here.

Old-fashioned defined-benefit pension plans have been replaced by defined-contribution benefit plans like IRAs and 401

Try living on that for 20 or 30 years.

Baby Boomers enjoyed the last vestige of an economy where you might hold one or two jobs throughout your most of your working career. They grew up in two-parent households and enjoyed the fruits of the postwar boom.

By contrast, many Generation Xers and younger Millennials have divorced parents, which reduced their financial security. Gen Xers got slammed by the 1987 stock market crash as well as the 2000 dot-com collapse; both Xers and Millennials lost jobs and savings during the 2008-09 Great Recession. They work in the gig economy. Younger workers might not have to drive for Uber or rent out a room on Airbnb but their work lives are highly mobile and frequently disrupted. They get laid off and outsourced. They must go back to school or move to adjust to employers' demands. Their real and net incomes are significantly lower than the Boomers' and their savings rate reflects that.

Next Page 1 | 2

URL: [opednews.com]

Enjoy being online again!

Welcome to the community of good people who base their values on evidence and appreciate civil discourse - the social network you will enjoy.Create your free account

3 comments

Feel free to reply to any comment by clicking the "Reply" button.Thank you for pointing out a HUGE problem facing our future. When people are old, sick, and have no money what will they do? Die? Social Security and Medicare provide a minimum safety net but it is troubling that so many people vote for Republicans who want to dismantle these "entitlements."

When my Dad died , my inheritance , was a policy his parents paid $0.05 a week for . It had a face value of $25.00 , and I spent about $5.00 getting the necessary documentation , in order to cash it in . What makes you think the baby boomers even expected , an inheritance ? Our parents grew up during the Great Depression , and World War II. When they began having families , they didn't have TVs or telephones . The first home my parents bought was a two bedroom , no bath in an area of Baltimore called Hampden . That's right , no bathroom . When you had to go , you walked to an outhouse at the end of the backyard . And yes, people did go to the Y , to get their weekly bath .

We grew up during the ** Korean War , the Cold War , and the Viet Nam War **. I knew single mothers of my generation working a full time job plus one or two or even three part time jobs to support their families , in part because of the discrimination in salaries between men and women . We earned our college degrees by working a full time job , to " pay as you go ." We didn't take out college loans , and the loans we did take out , we paid back , preferably ahead of schedule . Don't make up lies about us , so you can feel sorry for yourselves .

We didn't pay the the awesome amounts of money you do , for weekly entertainment . I see today's young adults buying season passes for Texas Rennaisence tickets , and the amounts of money they spend for cosplay garb . I know the cost of SciFi Conventions , Disneyland tickets , all plus hotel rooms and eating out . We never had computers growing up . Our parents didn't buy us cars .

For a true picture of the lives of the Baby Boomers , watch the ," Call the Midwives ," series on Netflixs... Who's buying any of that shit?

You're thirty years younger than I am . I wrote about history , as it was , not as you'd like to think it was . The depression , the wars are all historical facts . You can look them up . NO ONE handed us a rich life . You look at the end of our lives and think , Oh , wow , look how good they have it now , why don't I have all that they have , now . We worked for it . We paid our debts , instead of ," investing ," in retail thorpy . We didn't throw everything away after a single use . We didn't start with all the things you take for granted . The only shit here , is what you brought to the table .

I'm 57 and my wife is 54, so we are both X'ers, we are doing quite well but I know that there is a large cohort coming behind us that have not fared so well. I have been warning my Boomer friends for decades now that there will be a reckoning because we are not taking care of each other as a society but are playing an every man for himself game. The Boomers grow older and they grow weaker, the X'ers and Millennials grow hungry, who will it end badly for? When we are selfish and greedy, when we have no concern for our fellow man, when sense of community is abandoned, then the strong will eat the weak.

Like all parents , I always put the welfare of my children first , ahead of my own wants and needs . But you're right , and I do not expect them to be there for me , when I'm no longer able to care for myself . I supported them up to and including paying for collage for them . They made other choices . They threw that opportunity away . And they now regret not taking the education I was paying for . But a part of being a good parent is knowing when to let go . It's a bit like paying forward . My parents supported me , until I was able to stand on my own two feet . When I was 19 , they moved to another country , and I was on my own . Mine left , when they were ready . In the years since they moved out , I continued working , took on extra , made some investments , and secured my own future , because I am under no delusion , that the children I spent twenty years caring for , will have any interest in caring for me . They have their own families , and I have contributed to them , when they were in need . As for their concept of things , when my youngest was 18 and she was planning to move out , she came to me one day and said she had been thinking about things , and she thought the fair way of doing it , was to sell my house and she'd take half . I asked her , how much of the down payment she'd contributed , how much of settlement fees she'd paid , how many of the mortgage payments she'd paid , how much of the property taxes she'd paid , how much of the materials bought for remodeling/upgrades she'd bought ? Not one red cent had she contributed , yet she felt she was owed half .

Enjoy being online again!

Welcome to the community of good people who base their values on evidence and appreciate civil discourse - the social network you will enjoy.Create your free account

Share this post

Categories

Agnostic does not evaluate or guarantee the accuracy of any content. Read full disclaimer.