Who pays most of the taxes in this country?

Republicans claim that the super-rich, the top 1%, pay 40% of the taxes. This figure way off, because it does not take into account the FICA taxes (which include Medicare and Social Security), which apply only to the first $148K in personal income.

It also does not take into account state and local taxes, which impact ordinary people far more than they do the super rich. When Average Joe or Josephine buys a DVD, or a new phone, or a new car, the sales tax on that item is a FAR greater portion of his/her total income than it is for Mr. or Ms. Fat Cat.

Also, the rich can write off many of their ordinary expenses as business expenses. The limousine, the yacht, the jet, the apartment in Manhattan, the dinners at expensive restaurants, etc, etc., all write-offs, because they use all these things to entertain clients, travel to business meetings, etc.

Further, a large portion of wealthy people's income is unrealized capital gains (from rising value of stocks and other assets) which are not taxed at all.

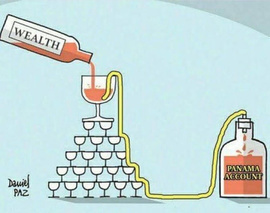

And then there are the assets that are hidden behind layers of front corporations, in offshore accounts.

Put it all together. The wealthy end up paying far less than what is commonly reported. The actual figure is closer to 8% when it's all said and done.

Bottom line, trickle-down economics is a hoax; it's high time the wealthy start paying their fair share.

Enjoy being online again!

Welcome to the community of good people who base their values on evidence and appreciate civil discourse - the social network you will enjoy.Create your free account

2 comments

Feel free to reply to any comment by clicking the "Reply" button.From the beginning "trickle down economics" has always been a huge con. The only thing that ever trickled down was the tax burden from the wealthy to working people.

It works like this. First they tell people that cutting taxes for the rich will create more jobs which will create a greater demand for labor. That is a lie. If a person owns a business and their taxes get cut, but demand for their goods and services doesn't change, then they won't be hiring anyone new at all, because ti will cut into profits. So that tax cut just grows the wealth for the person(s) whose taxes got cut.

So taxes get cut for the rich, and so the federal government has less money. So, the federal government cuts they money going to state and local governments, so now the states have less money. The states them raise taxes and fees to make up the difference. This is most visible in sales taxes, DMV fees and college tuitions, but it also increses taxes on utilities, professional and other licenses and fees. About a third of your cell phone bill is composed of various taxes.

So, in effect, the tax burden trickles down from the wealthy and onto working people.

Just a side note. The greatest economic growth and the greatest increases in the standard of living in the U.S. occurred from the end of WWII through the early 1960's, and at that time the top tier tax rates for the rich was 91%.

Which I guess means I should explain what is meant by "top tier". It is a part of the "progressive tax system" which was first proposed by Adam Smith in his 1776 book "The Wealth of Nations". The basic concept as put into practice is that nigher tiers of income should be taxed at higher rates.

To explain this without referring to actual tax tables, so we can simplify the explanation so it isn't overly complicated, it generally works like this. Keep in mind these are not actual tax figures or rates, but are only examples to demonstrate how progressive taxes are supposed to work.

Persons who make very little may not pay any income tax at all.

Persons who make 10,000 to 50,000 may pay 5% income on every dollar above 10,000 within that range.

Persons who make 50,000 to 100,000 may Pay 10% Income tax on every dollar within that range.

Persons who make 100,000 to 250,000 may pay 25% income tax on every dollar within that range.

Persons who make 250,000 to 1,000,000 may pay 50% income tax on every dollar within that range.

People who make 1,000,000 to 5,000,000 may pay 75% income tax on every dollar within that range.

People who make more than 5,000,000 may pay 90% income tax on every dollar more than 5,000,000

To be clear, a rich parson who makes more than 5,000,000 it only taxes at 90% in the top tier. Juet like every one on the tiers below them, they aren't taxed on the first 10,000 they make. For the money they make up to 50,000 they would be taxed at the same rate of 5%. For the next income tier of 50,000 to 100,000 they wold be taxed at 10% just like everyone else. For the rest of the lower tiers they are also taxes at the same rates at a person who only makes the amounts in those tiers.

If you think about it, it is only because of the work of other people whose income is in those lower tiers that such large incomes can ever be achieved. The larger the income, the less actual work was done by rich person to gain that income. So, it isn't exactly punishing a person for being successful, as conservative often claim, so much as it is recognizing who does the actual work that creates the wealth.

Now, let's look at how a progressive tax system benefits the country.

tt a rich person faces a top tier tax rate of 90%, then it makes less sense to take profits out of a company and reinvest it in modernization to increase productivity and to invest in research and development to improve products or to create new products. That is how the U.S. had such major growth in its economy and standard of living from the end of WWII to the early 1960's, which was when the first major tax cut for the rich was passed cuing tee top tier tax rate by about 20%.

When the tax rates encourage reinvestment, it benefits everybody, and THAT creates more and better jobs. You know... what republicans claimed cutting taxes for the rich would do, but it didn't.

Eat The Rich!

I hear human flesh tastes like pork. Hence the term "long pig."

Enjoy being online again!

Welcome to the community of good people who base their values on evidence and appreciate civil discourse - the social network you will enjoy.Create your free account

Share this post

Categories

Agnostic does not evaluate or guarantee the accuracy of any content. Read full disclaimer.