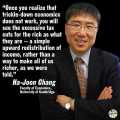

In 1918 the top tax bracket was 77%, in the Depression Years it was 63% for the Elites and during WWII it got as high as 94% on the top earners and through the 50's, 60's and 70's the top tax bracket never dropped below 70%. In the 80's we had trickle down economics and the top rate dropped to 50% but not much trickled down and now the rate for the 1 Percenters is back down near historic lows, with deductions and loopholes it is even lower. Maybe me we need more Trickle Up because nothing is coming down anymore except bullshit and lots of it.

Enjoy being online again!

Welcome to the community of good people who base their values on evidence and appreciate civil discourse - the social network you will enjoy.Create your free account

7 comments

Feel free to reply to any comment by clicking the "Reply" button.I've done work for the Super Rich and while some of them are decent people and down to earth, typically the artistic types and the entertainers, the ones who are 'In The Game' are completely out of touch with the rest of humanity. It becomes about keeping score and the money is just one way to keep score.

@FortyTwo Jodie is still really hot, to bad she plays for the other team. Like I ever had a chance. lol C'est la vie.

As long as politicians can stand up and talk about all those "cadillac welfare queens", etc etc....it is easy to sway the opinions of the under informed masses to believe that the only problem this country has is too many "lazy" people not wanting to work for a living and wanting a cradle to grave gov't welfare state. Not saying there aren't those out there for whom the shoe fits - but a society is only as strong as its working class - and that class is disappearing year by year. Those who used to count themselves as lower middle income are now part of the working poor....and those who manage to do a little better inch closer to upper income levels. The tiny slice left in the middle is groaning under the weight of trying to support both ends......don't tell me how grateful I should be because I'm getting $5.00 more on each paycheck now - and spending $10 more on each tankful of gas....and watching grocery prices rise every single week. Classic bait and switch....

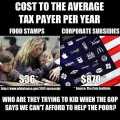

Who's the Real Welfare Queen?

Are you quoting Canadian tax rates? I do agree with you that as long as Trudeau is PM nothing but socialist BS will trickle down. LOL

American IRS data not Canadian CRS, Canada has a more balanced tax system that has the top 1 percent paying more of their fair share but not much more. I'm not a fan of Trudeau's but compared to that tin pot dictator wannabe he replaced he's a ray of sunshine.

So are you Canadians flying your flag at half staff because Castro died? Seems that Trudeau was pretty upset about the demise of that murderous dictator.

Well, I'm a confirmed Capitalist. I think that if I earn wealth, I shouldn't be penalized for my efforts.

How about a 10% income tax for everyone? No deductions or loopholes.

How about we have Real Capitalism again? This Corporatocracy doesn't promote free enterprise or present a level playing field for capitalists to grow or be innovative. The biggest Welfare Queens are the Mega Corps who feed at the government trough without shame or apology.

My understanding was....

There was a tax cut by JFK, which dropped the tax rate down to around 70$, when it was previously around 91%. The legislation supposedly closed tax loop holes, but once passed, congress (mostly republicans) quickly go to work to open some new loop holes for the wealthy.

When Reagan started "trickle down" (also sometimes referred to as "supply side" ) economics, the first George Bush, in the campaigns, called it "voodoo economics", because he knew it coudl nto be sustained over the long term.

What most voters didn't and still don't realize is that when the rich get tax cuts the Federal government has less money, so they cut funds that go to state and local governments, so now they have less money. So, state and local governments raise taxes and fees which are mostly paid by the bottom 90%. It is probably most noticeable in increased DMV fees, but there are countless other little fees that nickle and diem you to make up lost revenues from the tax cut for the rich, such as the taxes on your cell phone bill, other utility taxes, college tuitions at community and state colleges (as well as increased prices at student stores), local public parks start charging use fees (also National parks increase their fees too), lots more tolls on bridges and roads and higher fees on existing tolls, higher public transit fees, and so on. That is right, the only thing that ever trickles down is th tax burden. It is NEVER a tax cut, but rather in actuality is a transfer of the tax burden from the rich onto working people.

Even if income taxes are cut for working people, there are other taxes and fees whyich are increased to make up the lost revenues.

As the saying says, "There are only two sure things. Death and taxes."

Unless you are really rich, then you just might find a way to avoid both of those inevitabilities or at the very least postpone them.

A common statistic cited about our economy is that it is 70% driven by consumer spending. Consumer spending is "demand side." Cutting taxes for the rich is "supply side" economics aka "trickle down." Since Reagan, American economic policy has grown more and more supply side, which is wildly ineffective. We've been focusing far too much policy on increasing supply than on increasing demand. We liberals are often chastised as being "tax and spend." At least we pay for what we propose. Conservatives have given huge tax cuts while increasing spending on programs that benefit the wealthy- "cut tax and spend lavishly." It has led to huge deficits, which they claim to abhor. Union YES!!!

Enjoy being online again!

Welcome to the community of good people who base their values on evidence and appreciate civil discourse - the social network you will enjoy.Create your free account

Share this post

Categories

Agnostic does not evaluate or guarantee the accuracy of any content. Read full disclaimer.