Enjoy being online again!

Welcome to the community of good people who base their values on evidence and appreciate civil discourse - the social network you will enjoy.Create your free account

5 comments

Feel free to reply to any comment by clicking the "Reply" button.I need advice. I am badly crippled and I am on Social Security. I get SSI SSDI (the two payments totaling almost $800 per month), Medicaid and Medicare. I have a maxed out $10,000 credit card debt with VISA, which goes through my bank. My debt got so big, starting with the time my bank ripped me off by lying to me very badly, several times, causing my debt to start. I got depressed and started spending wildly and now I cannot pay it off and the interest and fees keep building. I have never stiffed anyone in my entire life, not even failing to tip a waitress, but I feel like I need to stiff the bank and VISA to get out of this hole I am in. I know lawyers charge a lot just to get a few simple questions answered. I also have written to several organizations that offer free legal advice and services, but none of them have ever replied to me, and all I want to know is can I file for bankruptcy in my situation, or maybe just stop paying my credit card bill. I read on one of the free legal aid sites that banks and credit card companies cannot collect money from people on Social Security by garnishing their SS checks, so I would be free of that debt just by not paying it anymore. I also have no assets except a crappy Toyota Corolla worth a few thousand dollars at best, and I cannot part with it till I can get a better car. Does anyone here know anything about this topic?

Sorry I don't..

Call 211 or go to 211.org - they can set you up with a free credit counselor. Good luck!

@sweetcharlotte - I have no student loans. I had one after I graduated from art school, but the loan company canceled it 26 years ago after I had a massive stroke, at age 26, 3 years after I graduated from college. I was originally told I would have to apply for a deferment every 6 months, but they canceled it after my first application. Bless their hearts. I do not own a house. I pay a modest rent to my family, that I will continue to pay. I own a used 2009 Toyota Corolla I bought for around $10,000 a few years ago, but I doubt if I could get more than $3,000 for it now, and I cannot do without it anyway. And I own nothing else of value, except my computer porn. (Well, I am a lonely old man) ;-P .

Thanks for your advice. I will look into your suggestion, but first I will look into the possibility of just stop paying it. The brochure called “Bankruptcy: What You Need to Know in Maryland” from “Maryland Legal Aid” says:

•If your income is protected from

creditors (such as Social Security,

SSI, other public benefits, and most

pensions), and the value of all of

your property is $12,000 or less, then

creditors cannot collect from you.

Even if you don’t file bankruptcy, your

creditors can’t legally take anything

from you.

It mentions SSI, but it does not mention SSDI. Besides finding out from a lawyer if this is true, I definitely need to find out if they can garnish my SSDI checks. I cannot survive without that money. One problem I anticipate is most lawyers will tell me I cannot just stop paying, because of course they will want to make $1,000 from me.

I have a cousin-in-law who is a retired lawyer, but he’s a dick, so I do not want to talk to him about it.

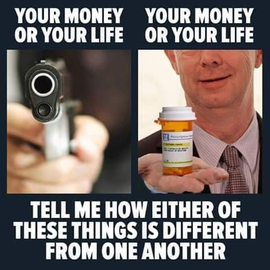

One kills you quick. Those who love you suffer less.

The other kills you and significantly hurts everyone around you slowly.

Recent Visitors 43

Hope4US

Deltona,

AmiSue

Fairfield County,

KoolioHandLuke

Baltimore,

Charlene

Brookline Ma,

CommonHuman

KS, USA

Photos 1,871 More

Posted by KilltheskyfairyIt’s the only way…

Posted by KilltheskyfairyIt’s the only way…

Posted by KilltheskyfairyIt’s the only way…

Posted by HippieChick58Donnie thinks he had every right to interfere with the 2020 election

Posted by KilltheskyfairyHappy Labor Day!

Posted by KilltheskyfairyHappy Labor Day!

Posted by KilltheskyfairyHappy Labor Day!

Posted by KilltheskyfairyHappy Labor Day!

Posted by KilltheskyfairyHappy Labor Day!

Posted by KilltheskyfairyHappy Labor Day!

Posted by KilltheskyfairyHappy Labor Day!

Posted by KilltheskyfairyHappy Labor Day!

Posted by KilltheskyfairyHappy Labor Day!

Posted by KilltheskyfairyCorporate greed!

Posted by KilltheskyfairyCorporate greed!

Posted by KilltheskyfairyCorporate greed!