Enjoy being online again!

Welcome to the community of good people who base their values on evidence and appreciate civil discourse - the social network you will enjoy.Create your free account

7 comments

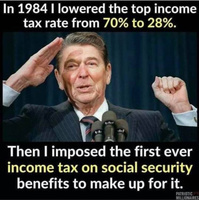

Feel free to reply to any comment by clicking the "Reply" button.The amount of taxing and spending that was done to "Win" the Cold War was complete insanity. The USA had most of the world's capital, most of the world's industrial infrastructure, and the most efficient economy in the world. If the rest of the world had inefficient Socialist/Communist/Marxist/Collectivitst economies, so what? Why did we spend Trillions to put everyone else on a level playing field?

Reagan spent billions to force the USSR to also spend like crazy trying to keep up and eventually went bankrupt. Stupidly, he and his successors kept spending at those levels even when there were no other countries capable of being competitive. Now we’re 20 trillion in debt with no chance of solvency and our shifterbrains president keeps giving tax cuts to the wealthy and corporations.

She’s not crazy at all; she’s spot on. ESPECIALLY after this huge Trillion+ dollar tax giveaway to the rich. THAT was crazy. Just to “pay back their donors”. Guess what. We, the middle and lower classes, will be paying that off, in many forms, for years to come.

And that 70% rate she's talking about is after the first 10 million.

of taxable income, not gross...so unless loopholes and credits are closed, it won't impact as much as one might think...

Each time we receive a social security check with taxes withheld I get so irritated...because my paycheck also has paid taxes on this as well...so, in reality, I am paying 60% tax on my income already...just a different way...so yeah...idiot tax laws...

No taxes were paid on taxes withheld. You aren't paying taxes on money that was already taxed.

"A worker's payroll tax contributions to Social Security in a given year are included in his or her taxable income for that year. In other words, workers pay income tax on the payroll tax. "

@sewchick57 Perhaps many don't because of the limit threshholds?

@sewchick57 If I understand it correctly, depending on your tax bracket, you may pay Federal income tax and state income tax on the portion of your FICA withholding not paid by your employer (taxes on approximately 7.2% of your gross income).

@sfvpool Your gross income is taxed for social security and medicare no matter what you make, with a cap of $132900 (only for SS) being the cut off for 2019. All employers must match it and send it in along with what they have taken out of your check. When you start collecting, depending on income, you pay taxes on what was taken out of your check and what your employer paid...I can see paying tax on what your employer contributed for you since they got to take it as a deduction and never paid tax on it...but for me to have to pay tax on my own tax is ridiculous.

@thinktwice I understand that. I was trying to communicate that in addition to the actual FICA tax, you may also be paying Federal and State taxes on that money, depending on your bracket. So you could be paying double taxes on your gross income: FICA tax + Federal and State tax.

@sfvpool I was not questioning the veracity of what you stated...simply supporting it with more information...thanks! And yes, state taxes are also collected on social security wages in 13 states...thank goodness, not mine!

Enjoy being online again!

Welcome to the community of good people who base their values on evidence and appreciate civil discourse - the social network you will enjoy.Create your free account

Share this post

Categories

Agnostic does not evaluate or guarantee the accuracy of any content. Read full disclaimer.